Recruiting user research participants that accurately fit the desired profile is essential for obtaining relevant and insightful results in UX research. In Business-to-Business (B2B) recruitment, this becomes even more critical. Unlike Business-to-Consumer (B2C) research, in which participants are often everyday users, B2B research demands participants with specific roles, expertise, and industry experience. These participants provide insightful feedback to allow product teams make informed design decisions and product development.

This article explores the intricacies of B2B participant recruitment by understanding the different profiles in B2C and B2B, examining the distinctive characteristics of B2B customers, and highlighting the challenges and potential solutions involved in a B2B research project.

To learn more about our other articles on participant recruiting, see below:

- Guide to using recruitment panel in Hubble

- How to create effective screener surveys for participant recruiting

B2C vs B2B Research Participants

Before we get into details about B2B participant recruitment, let's first identify the key differences between B2C and B2B, and understand which type of participants you need.

B2C vs. B2B Participant Recruitment in User Research

In UX research, participant recruitment can be broadly divided into two categories: Business-to-Consumer (B2C) and Business-to-Business (B2B).

- Business-to-Consumer (B2C): B2C recruitment focuses on engaging everyday consumers who use products and services in their personal lives. These participants are typically easier to find and recruit, as they represent a broad and diverse demographic.

- Business-to-Business (B2B): B2B recruitment involves engaging professionals who use products and services in a business context. These participants are often harder to reach due to their specialized roles, busy schedules, and the specific nature of their work environments. B2B participants are typically selected based on their professional expertise, industry experience, and specific job functions.

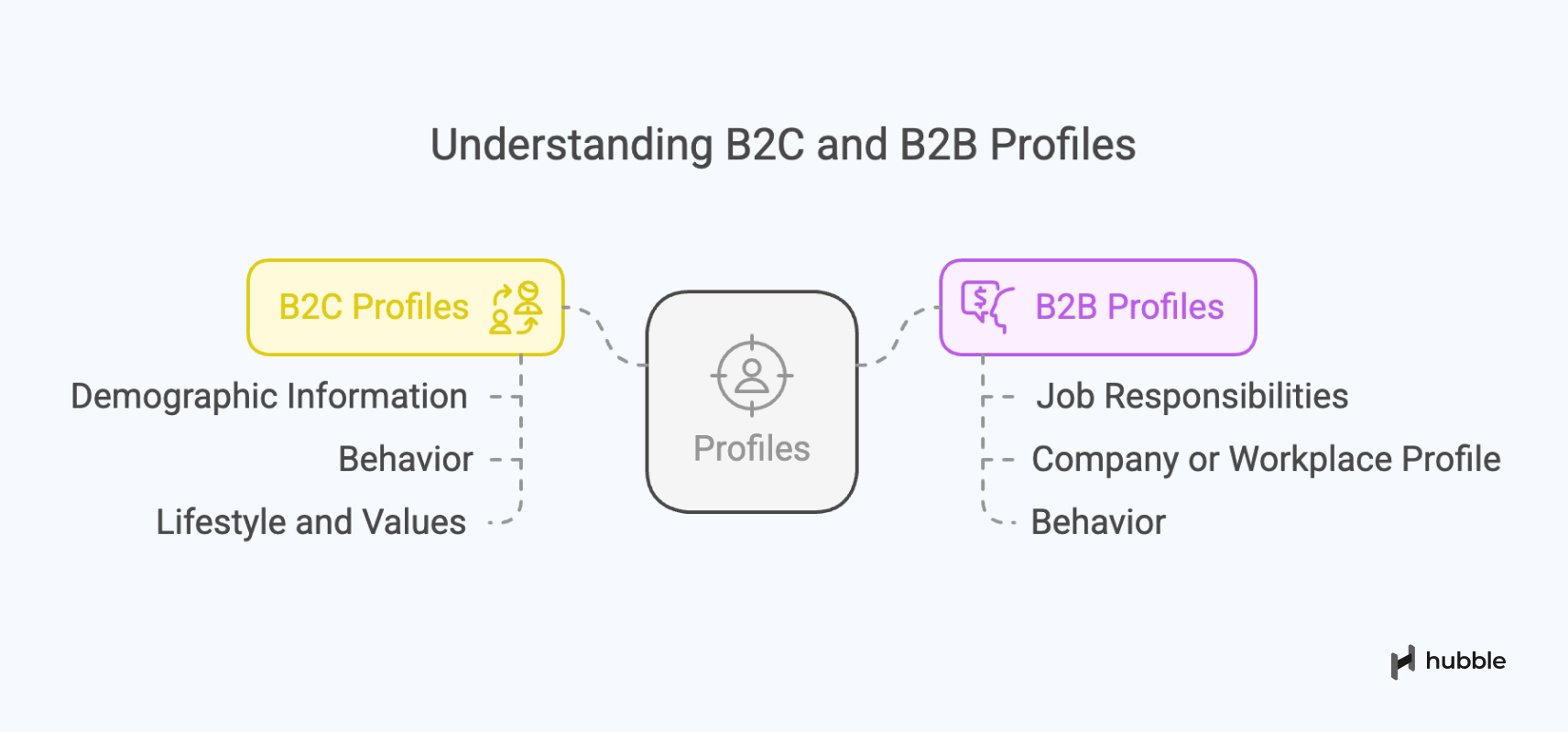

Different Profiles for B2C and B2B

As you list out study goals and details, it is important to identify key attributes of your desired customer pool. Below are some main characteristics you can capture with each type of participant:

Business-to-Customers Profiles

- Demographic information: (Demographic information, however, don't often tell much about your participant profile).

- Age range

- Gender

- Income level

- Occupation (e.g., Employment status)

- Geography (e.g., Region, urban vs. rural)

- Behavior:

- Purchasing habits and patterns (e.g., Frequent buyers, occasional, deal-shoppers)

- Loyalty to certain brand (e.g., Promoters, brand switchers, first-timers)

- Type of products or services they use (e.g., Using competitor products, using multiple products)

- Usage rates (e.g., heavy, moderate, light)

- Lifestyle and values:

- Lifestyle (e.g., Fitness enthusiast, early adaptors, eco-conscious consumer)

- Beliefs (e.g., Health, budget, comfort, sustainability)

- Interests (e.g., Fashion, travel, sports, games)

In addition to the characteristics above, there can be other socioeconomic and behavioral factors that can be specified depending on your product's problem space and research objectives.

Business-to-Business Profiles

On top of the B2C factors introduced above, B2B is characterized with specific job responsibilities and skillsets.

- Job responsibilities:

- Job titles (e.g., their official work titles and seniority level)

- Work responsibilities (e.g., How does their workflow look like?)

- Company or workplace profile:

- Industry type (e.g., Technology, healthcare, real estate, finance)

- Size of the company (e.g., Number of employees, annual revenue)

- Market position (e.g., Leaders, niche players, disruptors)

- Behaviors:

- Jobs-to-be-done and desired outcomes

- Pain points and challenges

In addition to the characteristics above, there can be other factors, such as procurement process and technology stack/usage, depending on your product's problem space and research objectives.

When defining your research participant criteria, focus on the characteristics and behaviors most relevant to your research needs.

If your study or usability test requires specific skill sets or professional roles outlined in B2B criteria, recruiting B2B participants will yield a higher research ROI than B2C. While B2B recruitment typically involves higher costs and incentives, it's more important to engage participants who can provide meaningful, actionable insights.

Examples of B2C and B2B Participant Profiles

B2C customers are generally assessed based on broad demographic criteria such as age, gender, income level, and lifestyle preferences. Below are examples of B2C participants:

- College student using a new educational app

- Stay-at-home parent testing a new kitchen appliance

- Fitness enthusiast evaluating a new wearable device

B2B customers are engaged based on their professional roles, industry experience, and specific skill. Below are examples of B2B participants:

- Software engineer with specific experience in tool or language

- Marketing manager evaluating a new analytics software

- Healthcare professional assessing a new patient management system

These participants are recruited based on their professional roles, industry experience, and specific skill sets.

The complexity of recruiting B2B participants

Conducting research that involves B2B profile is inherently more complex and time-consuming than studies that focuses on everyday consumers. This complexity arises from the need to identify individuals with specific skill sets, workflows, and behaviors that align with the research objectives. For example, if your study is about a new project management tool, you will need to find participants who are not only familiar with project management but also have experience using similar services in a professional setting.

Moreover, B2B participants often require more personalized and targeted recruitment strategies. Unlike B2C participants who can be recruited through broad channels, such as social media and online surveys, B2B participants may need to be reached through industry-specific networks, professional associations, or direct outreach.

“There’s more demand for unmoderated research than ever, but to get quality insights, you need quality participants. Knowing exactly who every participant is means that you’re testing your products with the right audience, so you're getting insights that improve your product and business.”

Jack Pratten

CEO at Respondent

Common Challenges in Recruiting B2B Participants

1. Limited pool of eligible participants

One of the most significant challenges in B2B recruitment for user research is the limited pool of eligible participants. Unlike B2C, in which the target audience is vast and diverse, B2B often requires customers who meet very specific criteria. These criteria can include industry experience, executive-level job title, company size, and familiarity with certain technologies or processes.

The specificity of these requirements narrows down the pool of eligible participants, making it difficult to find suitable candidates. This scarcity can lead to extended research project timelines and increased costs, as more resources are needed to identify and engage the right individuals.

2. Detailed skillsets or seniority

In addition to a limited pool of participants, B2B recruitment often involves finding individuals with specific skill sets or seniority.

These individuals not only need to have the right job title but also have the relevant experience and responsibilities. This level of specificity can make recruiting highly complex, requiring detailed screening and vetting procedures to ensure that participants meet all the necessary criteria.

3. Time constraints and scheduling difficulties

Time constraints and scheduling difficulties are another major hurdle in B2B studies. Unlike general consumers, who may have more flexible schedules, B2B participants are often working professionals with demanding jobs and full-time schedule. Their availability is limited, and coordinating schedules can be a logistical nightmare.

This is particularly true for high-level executives or decision-makers, who may have packed calendars and limited availability. The challenge is not just finding the right participants but also aligning their schedules with the research timeline, which can lead to delays and rescheduling issues.

4. Motivating participants to engage

Motivating B2B customers to engage in UX research is another significant challenge. Unlike consumer-based research, where monetary incentives or small amount of Amazon gift cards can be effective, B2B participants, especially executives and decision-makers, require more substantial motivation. These individuals often have high opportunity costs, meaning that the time they spend participating in research could be spent on more pressing business matters.

The incentives need to be compelling enough to justify their participation. This could include offering exclusive insights from the research, networking opportunities, or even higher monetary compensation. Crafting an appealing value proposition is crucial to securing their engagement.

5. Privacy and compliance concerns

Ensuring confidentiality and compliance can be a critical concern in B2B studies. Especially when your research study involves contextual inquiries or user interviews that examine detailed workflow and processes specific to participants' organizations, the amount of information that participants can share could be limited. Many participants will be reluctant to share their screens.

Participants need to be assured that their insights and data will be handled with the utmost confidentiality, especially when discussing proprietary technologies or business strategies. You have to be clear about what type of data you are collecting, and how none of personally identifiable information will be collected during the research process. Ultimately, clear communication about how data will be used, stored, and protected during the consent process can help build trust and encourage participation.

We've looked at some of the most common challenges when recruiting B2B participants for your research study. These challenges overall make it costly both in terms of money and research turnover time. By understanding major challenges involved with B2B recruiting, there are other strategies to effectively handle the process.

Channels to Recruit Participants

Successfully recruiting participants for B2B user research can often be a hurdle for businesses. Identifying the right participants, engaging them, and ensuring their participation can be challenging. Below, we explore a few recruitment methods that researchers use to overcome common B2B recruitment challenges.

1. Utilize Recruitment Panels

Recruitment tools like Respondent and UserInterview offer access to a vast pool of participants who have expressed interested in participating in paid research studies. They are trained to be testers, navigate online research tools, and typically know how to think-out-loud during a research session.

With Hubble, you gain access to over 7 million participants, streamlining your research process by building the study and participant recruiting by sourcing participants directly from Respondent and User Interviews. As long as you have study credits in Hubble, you get to reach participants of high quality without registering or paying in Respondent or User Interviews.

Benefits of Recruitment Panels

- Wide reach: Access to a large, diverse pool of candidates.

- Efficiency: Generally quick fulfillment of recruitment needs with access to millions of participant panel. Moreover, platforms offer automated scheduling. You can get first qualified participant scheduled as quick as 20 minutes.

- Quality: Higher likelihood of finding participants who meet your specific criteria.

2. Cold or Warm Contact via Social Networks

Social channels, particularly LinkedIn, are powerful tools for B2B recruitment. LinkedIn allows you to search for specific job titles and companies, making it easier to connect directly with research participants.

Best practices for LinkedIn recruitment

- Personalize your message: Avoid sending generic mass messages. Tailor your outreach messages to increase the chances of a positive response.

- Build relationships: Engage with potential participants to get to know more about them and their professional career, needs, and interest.

- Leverage LinkedIn Ads: A bit more nuanced, but target specific demographics and job titles with LinkedIn's advertising platform to find qualified participants.

3. Leveraging Product Users

Your existing user base or external recruitment panel can be an excellent source of research participants. User research is a team effort and building relationship with colleagues from marketing and sales team could come in handy with getting access to your users. Collaborate with your marketing or sales teams to identify potential users who may be willing to participate.

Strategies for reaching product users

- In-app notifications: Use in-app messages or pop-ups to invite users to participate in your study.

- Email outreach: Send targeted email campaigns to your marketing list or blog.

- Customer feedback programs: Incorporate study participation opportunities into customer satisfaction surveys and feedback forms.

4. Industry Conferences

While less common, attending industry conferences and trade shows can provide valuable networking opportunities for B2B UX research recruitment. Setting up booths or tables where you can showcase your product and directly engage with eligible candidates can be highly effective.

Professionals that are attending industry-specific events are often passionate about their field and work, which mean that they often have much to say about their field and share context-based relevant experiences.

Establishing relationship in-person is effective for building your own panel in the long term. Also, showing yourself to those industry-specific conferences and events show how much you and your company are devoted to speaking with customers.

Tips for conference engagement

- Networking: Take advantage of networking sessions and speak directly with attendees.

- Presentations and panels: Participate in or sponsor speaking engagements to highlight your research needs.

- Follow-up: Collect contact information and follow up with potential participants after the event.

5. Professional Associations and Online Groups

Professional associations and online groups can be useful for recruitment, though they often have gatekeepers and restrictions on advertising. Nonetheless, they are worth considering for their targeted audiences.

Tips for utilizing online groups

- Read group rules and restrictions: There could be restrictions on advertising or recruiting as those groups typically only allow posting related to the profession. Make sure that you are following the group rules.

- Networking events: Attend association-hosted online or in-person events to meet potential participants.

6. Company Websites and Directories

For highly niche groups, company websites and industry directories can be helpful especially when you know certain key players in your market. Search through their websites, contact pages, and team members page to discover potential candidates.

You can follow-up with potential candidates through Linkedin to establish connection.

7. In-product Surveys

Platforms like Hubble allow you to generate pop-up surveys directly within your product, making it easier to recruit participants from your actual user base. This method ensures you get feedback from active users who are engaged with your product.

Tips for implementing in-product surveys

- Timing is key: Display surveys at moments when users are likely to have insightful feedback, such as after completing a specific task.

- Question design: Keep surveys short and focused to maximize response rates.

Best Practices for Effective B2B Recruiting

With the right strategies and practices, you can streamline your recruitment and the overall research processes. Whether its for a qualitative or quantitative research, below are some of the best practices to keep in mind:

1. Transparent Communication and Customized Messages

Clear and personalized messages in your recruitment materials are critical when recruiting B2B participants. Here are some tips:

- Tailor each message: Address the individual by name and highlight how their specific expertise and experience will be valuable for the research.

- Explain the purpose: Clearly state the purpose of the research and how their participation will contribute to product development.

- Maintain transparency: Ensure that both you and the participant understand the expectations from each side. Avoid any miscommunication to save time for both parties.

2. Offer Meaningful Incentives

B2B participants often have busy schedules, making it essential to provide attractive incentives:

- Monetary rewards: Offer competitive compensation for their time and expertise.

- Demonstrate value: Explain how their feedback will directly have impact on the product that could also benefit their teams or work.

3. Build Long-term relationships

Engaging B2B participants for the long term can enhance the quality and reliability of your research:

- Follow-up communication: Send thank-you notes and periodic updates to maintain engagement.

- Regular updates: Keep customers informed about how their feedback has been implemented. Participants will be pleasantly surprised when they hear how their feedback have been addressed and become more loyal to your product.

4. Leverage referral programs

Referrals can be an effective way to connect with customers with similar experience or background.

- Encourage referrals: Ask current participants to refer colleagues or relevant business contacts.

- Incentivize referrals: Offer incentives for each successful referral to motivate participants.

5. Create effective screeners

Screening participants carefully ensures you get the right respondents for your study. Consider screener surveys as the first step in understanding potential participants. Include questions that help you evaluate their relevance to your research needs.

- Include red-herring questions: Use these to filter out candidates who may not be suitable.

- Avoid leading questions: Leading questions can prime participants to provide desired answers.

- Avoid using strong emotive words: Make sure your screener appears exciting without sounding leading.

- Avoid use of binary yes-no questions: Binary yes-no questions don't tell much. Instead, frame the questions starting with how or what.

6. Prepare backup participants

Having a backup plan ensures that your research is not delayed:

- Loosen the criteria as needed: Be ready to adjust your criteria slightly to include more potential participants if your primary pool is insufficient.

- Over-recruit: Consider recruiting a few extra participants to account for no-shows or dropouts.

7. Establish an in-house recruitment panel

Building an in-house recruitment panel can significantly streamline future recruitment efforts. This approach reduces the time and cost associated with recruitment for each new project and ensures access to high-quality, vetted participants.

- Track quality participants: Maintain records of participants who provided valuable insights and showed professionalism.

- Regular engagement: Stay in touch with quality participants and keep them informed about future research opportunities.

- Exclusive panels: Create a panel of trusted participants who can be called upon for future studies, reducing recruitment time and costs.

In this post, we explored the intricacies of participant recruiting in user research, with a particular focus on the technical and complex nature of B2B recruitment and how we could employ various recruitment methods.

We discussed common challenges and highlighted common recruitment channels that researchers use to get in touch with niche participants. By following the best practices in recruitment, you should be able to improve the recruitment process for your future projects.

.png)